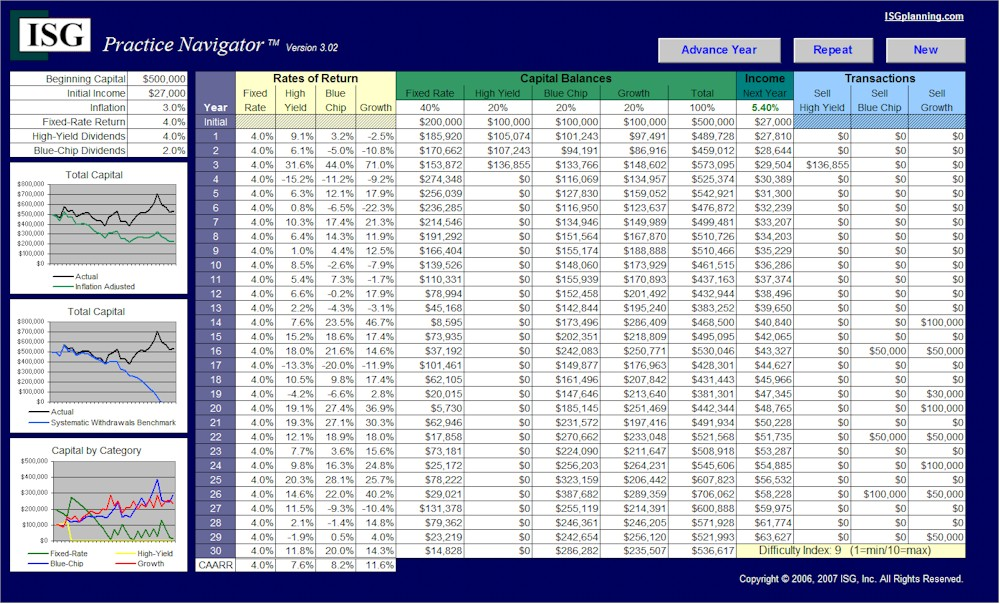

Practice Navigator

- Category

- Business

- Financial Calculators

- Developer: ISG, Inc.

- Home page: www.isgplanning.com

- License type: Free

- Size: 178.69 KB

- Download

Review

Have you ever wondered how much income you could reliably maintain from your investments and wished that you could have a practice run? The Practice Navigator allows you to do just that. It simulates real-life stock market variability so that you can practice making investment decisions without the risk of financial loss. You will decide how your capital is allocated, how much income to withdraw, and when to sell stocks. As with real financial markets, some of the simulated Monte Carlo scenarios will be more difficult than others. See if you can maintain your desired income for up to 30 years. Compare your results to a systematic withdrawals benchmark.