Discounted Cash Flow Analysis Calculator

- Category

- Business

- Financial Calculators

- Developer: Wheatworks Software, LLC

- Home page: www.discountedcashflowanalysis.com

- License type: Commercial

- Size: 2.6 MB

- Download

Review

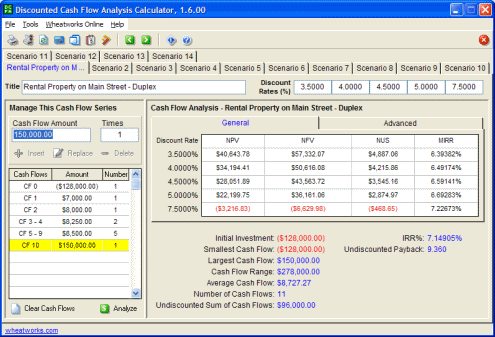

Discounted Cash Flow Analysis Calculator is analytical software designed to assist you with capital budgeting and investment analysis. This software simultaneously evaluates the cash flow series of 14 projects against 5 different discount rates per project. Capital budgeting is the process of evaluating cash flow series associated with investment projects are worth pursuing. Discounted Cash Flow Analysis Calculator offers you the ability to evaluate and compare 14 different projects at once. From simple investment projects like purchasing rental property to complex long-term investment ventures, Discounted Cash Flow Analysis Calculator quickly analyzes cash flow series using these capital budgeting methods: net present value (NPV), internal rate of return (IRR), discounted cash flow (DCF), modified internal rate of return. For each of the 14 capital budgeting project's cash flow series' five discount rates, Discounted Cash Flow Analysis Calculator calculates the following values for you: Modified Internal Rate of Return (MIRR), Net Present Value (NPV), Net Future Value (NFV), Net Uniform Series (NUS), Present Worth Cost, Present Worth Revenue, Benefit/Cost Ratio, and Present Value Ratio. Simultaneously, for each of five, user-defined, discount rates associated with each of the 14 cash flow series, Discounted Cash Flow Analysis Calculator provides: Net Present Value (NPV), Net Future Value (NFV), Net Uniform Series (NUS), Modified Internal Rate of Return (MIRR), Present Worth Cost, Present Worth Revenue, Benefit/Cost Ratio, Present Value Ratio. Discounted Cash Flow Analysis Calculator is designed for these Windows operating systems: 95, 98, ME, NT4, 2000, XP Home and XP Professional systems. With integrated help, a glossary of Cash Flow Analysis