FinOptions XL

- Category

- Business

- Stock and Portfolio Tools

- Developer: Derivicom, Inc.

- Home page: www.derivicom.com

- License type: Commercial

- Size: 1.28 MB

- Download

Review

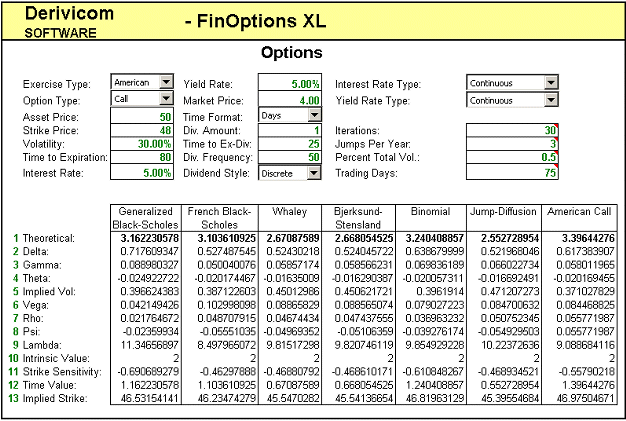

FinOptions XL is an Excel Add-in that extends its functionality by adding functions for analyzing derivatives. Similar to the built-in functions in Excel, FinOptions XL functions can be added directly into the cell formulas. FinOptions XL provides a complete collection of financial functions for analyzing derivatives on various types of securities and assets. FinOptions XL calculates price and the risk sensitivities as well as implied volatility and implied strike using either the Black-Scholes, French Black-Scholes, Cox-Ross-Rubinstein and Hull binomial, Whaley, Bjerksund-Stensland, Merton’s jump-diffusion, or the Roll, Geske, and Whaley American call model. FinOptions XL functions can adjust for continuous dividend yield and discrete dividends as well as yield rates, which allows the user to price options on: bonds, commodities, equities, foreign currencies, futures and stocks. FinOptions XL has a sample template and documentation that accompany the software to demonstrate each of the functions and give the user to starting point to being using them. FinOptions XL was built on our C++ written developer library, which provides lightning fast calculation.