FinOptions Dev

- Category

- Programming

- Components and Libraries

- Developer: Derivicom, Inc.

- Home page: www.derivicom.com

- License type: Commercial

- Size: 1.13 MB

- Download

Review

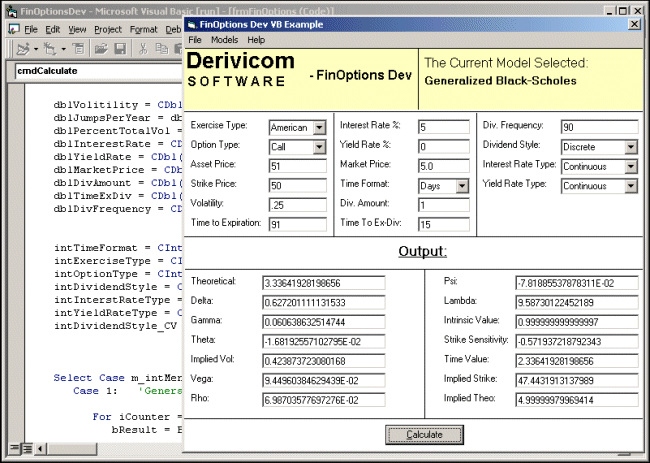

FinOptions Dev is an ActiveX library that enables developers to incorporate derivative analysis into custom third-party applications. Typical applications would be custom trading systems, a back office portfolio analyzer, and FASB compliance analysis. FinOptions Dev provides a complete collection of financial functions for analyzing derivatives on various types of securities and assets. Each function calculates theoretical value, sensitivities, implied volatility and implied strike. FinOptions Dev has a straightforward object model. All of the functions easy integrate into any new or existing third-party application. Every functions can adjust for dividends and yield rates, which allows the user to price options on: bonds, commodities, equities, foreign currencies and futures. FinOptions Dev has a sample application and documentation that accompany the software to demonstrate each of the functions and give the user a starting point to being using them. FinOptions Dev has been tested extensively enabling the user to save time and improve their calculations accuracy. It was written completely in C++, which provides lightning fast calculation.