Business Valuation Model Excel

- Category

- Business

- Financial Calculators

- Developer: David Morcom

- Home page: www.bizpeponline.com

- License type: Commercial

- Size: 420 KB

- Download

Review

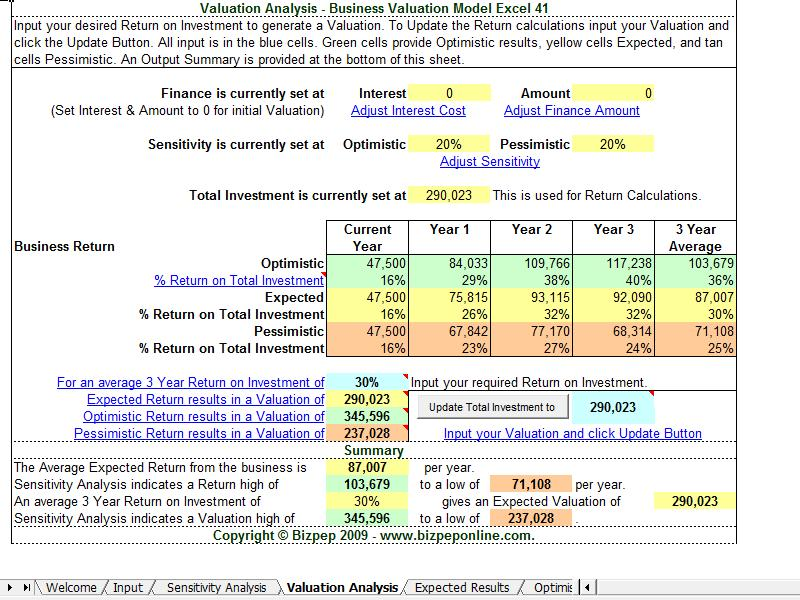

The Business Valuation Model Excel combines relative indicators for future performance with basic financial data (Revenue, Variable and Fixed Costs) to value the business. This valuation method can be used for business purchase, sale, or establishment. The model uniquely applies your intuitive business and market knowledge to provide a 3 year performance forecast with sensitivity analysis, investment return, and a business valuation. It is compact, easy to use, and requires minimal inputs. Outputs include a 3 year performance forecast with the ability to apply Sensitiyity Analysis and produce Optimistic, Expected and Pessimistic forecasts. A Return on Investment and Business Valuation are provided for each forecast. Outputs are presented in tabluar and graphical form. The model is easy to use and interpret.