OptionsXL Pro

- Category

- Business

- Misc Financial Tools

- Developer: OLSOFT

- Home page: www.analyzerxl.com

- License type: Commercial

- Size: 2.8 MB

- Download

Review

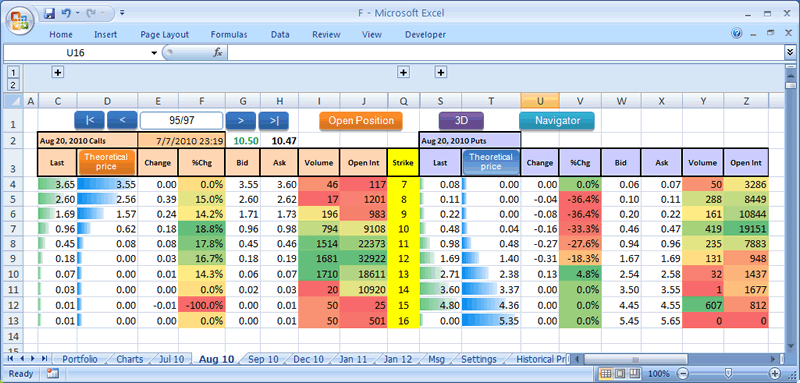

OptionsXL Pro is a ready-to-use solution for options data download and analysis in MS Excel. It is designed to help traders perform precise market analysis and make reasonable decisions. OptionsXL Pro is provided as a ready Excel workbook set up for a specific ticker the user needs. OptionsXL Pro works seamlessly in Microsoft Excel environment and supports one workbook per one option chain. TraderXL and AnalyzerXL packages buyers are eligible to obtain 5 and 3 OptionsXL Pro workbooks, respectively. OptionsXL Pro main features include: - Ability to store and display options historical prices; - Ticker data download and various types of Historical Volatility calculation (with charts); - Portfolio price is automatically recalculated according to further options data download; - After the historical theoretical options price is prepared (for a specific option and Strike) and a chart is built the values in the spreadsheet are automatically recalculated according to newly downloaded historical data for the ticker; - Charts and diagrams showing both Calls and Puts: - Liquidity; - Volume; - Market and theoretical prices dependency; - Real volatility (shows what market “thinks” about an option and stock); - Greeks; - Open Interest; - Historical theoretical price; - And many other charts. - The charts and diagrams instantly connect data for various dates of expiration and options historical prices; - The prices can be calculated with account of commission of the following brokers: - TD AMERITRADE; - E*Trade; - Schwab; - Fidelity; - Trade Station. - New NavigateXL module is included. It provides quick and convenient navigation between the spreadsheets of the workbook as well as other useful features; - What if analysis function allows changing stock price and volatility values and watching how it is reflected in the charts.